Diamond / Gold investment

PREMIUM

Global Diamond Investment Bank

In a perspective of proper diversification, normally the investor invests in diamonds a marginal part of his assets, around 5%, knowing to invest in a safe asset, not speculative, as a form of protection, security and serenity.

Tranquility also determined by the certainty of being able to disinvest: as an investment product, the diamond must be able to be disinvested and GDIB undertakes to replace the stones with a timing of maximum 30 days, in a time frame so short and with certain modes, and costs in line with other financial products.

Records show that each request for disinvestment has always been actioned in time not exceeding the average of 10 working days.

Global Diamond Investment Bank is therefore a complete service that accompanies the client from the time of the investment until eventual sale

PREMIUM

In The Hand Of The investor

The diamond,

a real product for everyone,

in the hands of the investor,

with a high intrinsic value

and able to bring concreteness and tangibility

in a financial environment usually characterized by immateriality

PREMIUM

Global Diamond Investment Bank Deposit

Certified by the two largest gemological institutions internationally to ensure a universal standardization, scientifically attesting its features.

The two international institutes are Hooge Raad voor Diamant (HRD) and Gemological Institute of America (GIA). A multitude of other Gemological laboratories exist in the world without the same international recognition or prestige.

Sealed in a blister pack of the same certification authority (HRD or GIA), so that they cannot be forged.

Stamped with the laser on the Crown of the Diamond: the stamp indicates the number of certificate and allows the diamond to be uniquely associated with its certificate.

Priced quarterly on major financial newspapers.

Insured by a policy “All risks” attesting the characteristics and value of the stones and cover with no excess risk of theft and robbery when stored in a safe deposit box or safe at home.

Ethical respecting the 4 ONU resolutions (n. 1173, 1176, 1306, 1343) that attest to the lawful origin from countries not involved in war, terrorism and exploitation of children and respond to the Kimberly Process Certification Scheme that guarantees its traceability.

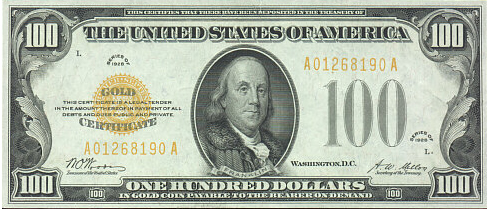

Gold Investing Guide

This Investor’s Guide is for anyone interested in gold, silver, and the history of money. In it you will find the key elements of the inner workings of the market, the players, the reasons they buy and sell gold, and how they do it. We use several tools (articles, charts, interviews, videos with simple explanations) that will help you understand the gold market and the different solutions for investing in gold and silver.

Why Should You Buy Precious Metals?

In times of economic and monetary crises, such as now, the savvy investor buys gold to protect his or her wealth. Gold has played its role of reserve of value for thousands of years. The level of debt has reached epic proportions that make it impossible to reimburse and, in such a complex and interconnected financial system, default from one of the major players in the economy (financial institution, government…) could trigger a systemic collapse. So, the rational investor turns to tangible and liquid assets that are neither backed by debt or the responsibility of a third party: precious metals.

The Gold Market

The price of gold evolves constantly, five days a week, around the world, from the open of the Asian market on their Monday morning (Sunday 3pm EST) to the close of the US markets on Friday (4:00pm EST). A benchmark price, called “the fixing”, is determined twice a day. According to estimates, the daily volume of combined paper and physical gold was 139 million ounces in 2013, worth $196 billion.

- 105 million ounces are traded daily between clients of the London Bullion Market Association (LBMA)

- 32.15 million ounces on the COMEX and other futures venues

- 1.16 million ounces via ETF funds

- 0,56 million ounces traded via consumer demand

If we compare the trading volume of the GOLD:USD pair to the other pairs, USD:EUR, USD:JPY, gold is the sixth most-traded currency every day.

Recently, several indicators, such as the GOFO rate turning negative and major deliveries on the Shanghai Gold Exchange, are signaling significant stress on the physical gold market.

How do I Invest in Gold?

There are several ways to invest in precious metals, and the simplest and safest way is to buy bars and coins. It is also possible to invest in “paper gold” financial instruments.

Paper Gold

These financial products (ETF funds, futures, certificates and gold mining stock) are generally recommended by banks and destined for speculation. They should be viewed with a risk/reward perspective. The fees are minimal because they require little administrative work and handling. However they do not offer the same guarantees as physical gold and expose you to intermediation and, thus, counter-party default risk, such as default by your bank or broker.

Bars and Coins

When buying gold, one looks for an easily identifiable and tradable product. This is why refiners produce marketable gold bars and gold coins with weight, purity and brand inscribed on them. Prices are determined by weight in gold, to which is added a premium for refining and producing. The smaller the bar or the more detailed a coin, the higher the premium. For example, the premium on “Good Delivery” 400oz bars traded on the international market is lower than the premium on 1kg (32.15 oz.) bars. For the private investor, however, the 1kg bar is much more practical and offers more liquidity.

Once you have determined which gold bars or coins you want to buy, an essential question remains: Where to store them? There are several solutions available, but your priorities should be maximum safety and liquidity.

WHY STORE YOUR GOLD OUTSIDE THE BANKING SYSTEM?

There are many risks associated with storing gold in the banking system, notably the risk of bankruptcy or government confiscation.

RISK OF BANKRUPTCY OR “BANK HOLIDAYS”

Investing in gold is generally done as a security measure to protect oneself against the risks associated with the fragility of the financial system, and to have access to a universally accepted means of payment in case of bank failure or temporary closing (bank holiday).

If you hold your gold in a bank’s vault and the bank closes temporarily or, worse, goes bankrupt (as was the case in Argentina), you lose the advantage of immediate access to a means of payment for your basic needs in times of trouble, when access to traditional means of payment like cash or bank cards is hampered.

The risk of bank failure is serious and real, with the banking system being entirely inter-connected.

GOVERNMENT CONFISCATION

Even though the risk is small, confiscation has occurred (Roosevelt’s Executive Order 6102 in 1933). Confiscation could happen following panic in the banking system or just before announcing a new monetary system. In that case, owning gold in one’s country of residence is risky because it can be legally seized.

Globaldib.com has its storage facilities in Switzerland, which eliminates the risk of confiscation for most of our clients.